When your Georgian silver tea set needs an appraisal for insurance or your inherited sterling collection requires valuation for estate taxes, understanding the legal landscape becomes crucial. Improper appraisals can lead to IRS audits, insurance claim denials, or significant financial penalties that could cost you thousands.

The legal framework governing antique silver appraisals involves multiple layers of federal regulations, professional standards, and state licensing requirements. Whether you're dealing with probate court, charitable donations, or insurance claims, your appraisal must meet specific legal criteria to be accepted and defensible.

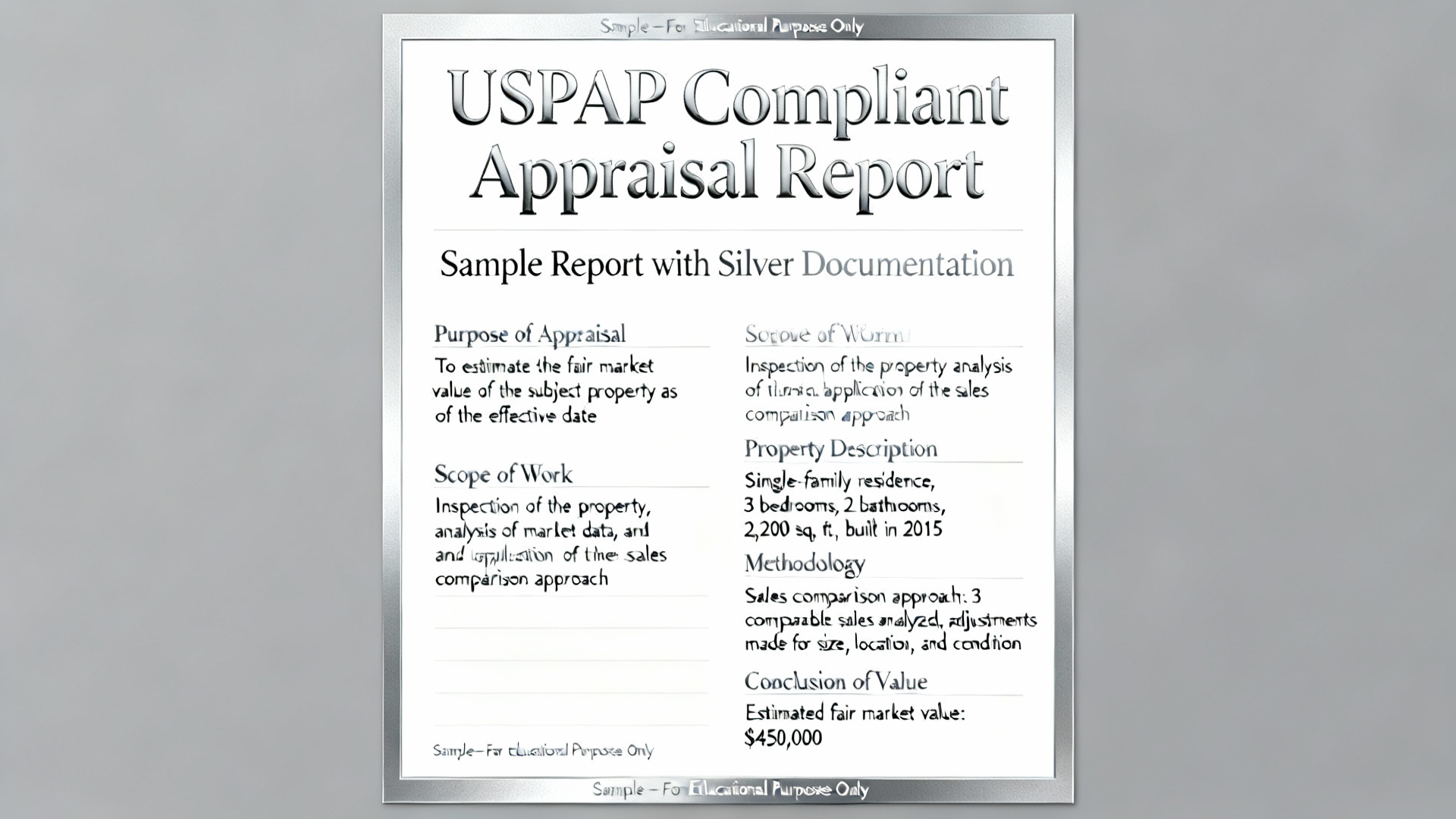

Key fact: USPAP (Uniform Standards of Professional Appraisal Practice) compliance is mandatory for all federally related appraisals, including those used for tax purposes, insurance claims over $5,000, and charitable donations exceeding $500.

Here's what you need to know about the legal requirements, potential consequences, and how to ensure your antique silver appraisal meets all necessary standards.

The Uniform Standards of Professional Appraisal Practice serves as the foundation for all legally defensible appraisals in the United States. For antique silver, USPAP Standards 7 and 8 specifically govern personal property appraisals and establish the minimum requirements your appraiser must follow.

Under USPAP, your appraiser must provide a detailed analysis that includes the item's physical condition, historical significance, maker identification, and current market value. They're required to document their methodology, research comparable sales, and maintain independence from any financial interest in the outcome.

The documentation requirements are extensive. Your appraisal report must include high-quality photographs showing hallmarks, maker's marks, and any damage or repairs. The appraiser must also verify provenance when possible and explain how they determined authenticity. Understanding what to look for when appraising antique silver helps ensure your appraiser follows these critical documentation standards.

For IRS purposes, the appraiser cannot charge fees based on a percentage of the appraised value. This contingent fee structure is prohibited and will invalidate your appraisal for tax purposes. Instead, appraisers must charge flat fees or hourly rates that don't create conflicts of interest.

Important note: Appraisals for charitable donations over $5,000 require the appraiser to complete IRS Form 8283, and they can face penalties up to $1,000 per violation for non-compliance with federal standards.

Not everyone can legally appraise antique silver for official purposes. The IRS requires appraisers to meet specific educational and experience standards, particularly for donations and estate valuations.

Qualified appraisers must hold credentials from recognized organizations like the American Society of Appraisers (ASA), International Society of Appraisers (ISA), or similar accredited bodies. These credentials require extensive education, testing, and ongoing professional development to maintain. When selecting an expert, finding a reliable antique silver appraiser with proper credentials is essential for legal compliance.

For antique silver specifically, your appraiser should demonstrate specialized knowledge in precious metals, historical periods, maker identification, and current market trends. Many qualified appraisers also hold additional certifications in gemology or metalwork that enhance their expertise.

State licensing adds another layer of requirements. While not all states require appraisal licenses, many do for certain types of work. Your appraiser should be familiar with your state's specific requirements and maintain any necessary licenses or registrations.

The experience requirement is equally important. IRS-qualified appraisers must demonstrate they've regularly performed appraisals of similar items and can provide references for their work. This experience helps ensure they understand the nuances of antique silver valuation and current market conditions.

The stakes for inaccurate appraisals extend far beyond simple mistakes. Both appraisers and clients can face serious legal and financial consequences when appraisals don't meet required standards.

For charitable donations, overvalued appraisals can trigger IRS audits and result in penalties equal to 20% of the underpayment of taxes. In severe cases involving gross overvaluation, penalties can reach 40% of the underpayment. The IRS also has the authority to disallow the entire deduction if the appraisal is deemed unreliable.

Insurance implications are equally serious. Undervalued items leave you financially exposed in case of theft or damage, while overvalued items result in unnecessarily high premiums. Insurance companies can deny claims if they determine the appraisal was inaccurate or didn't follow proper procedures. Understanding the benefits of professional antique silver appraisal helps protect you from these costly scenarios.

In probate and divorce proceedings, inaccurate appraisals can lead to unfair asset distribution and potential legal challenges from other parties. Courts expect appraisals to be thorough, unbiased, and professionally conducted according to established standards.

Appraisers themselves face professional liability for substandard work. They can lose their credentials, face lawsuits from clients, and be held financially responsible for damages resulting from their errors. Professional liability insurance is essential but doesn't protect against intentional misconduct or gross negligence.

The purpose of your appraisal significantly impacts the legal requirements and tax implications you'll encounter. Each use case has specific rules that must be followed for the appraisal to be legally valid.

For insurance purposes, appraisals typically establish replacement value and aren't directly taxable events. However, the appraisal becomes crucial if you need to file a claim, as insurance companies will scrutinize the documentation and methodology used. Proper preparation for an antique silver appraisal ensures you have all necessary documentation ready.

Estate and probate appraisals require fair market value determinations that directly impact tax calculations. These appraisals must be completed by qualified professionals and filed with appropriate tax returns. Executors can be held personally liable for taxes owed due to undervalued assets.

Charitable donation appraisals have the most stringent requirements. Items valued over $5,000 require qualified appraisals, and the appraiser must sign Form 8283 acknowledging their liability for accurate valuations. The timing is also critical - appraisals must be completed within 60 days of the donation date.

Appraisal PurposeValue TypeIRS Form RequiredAppraiser QualificationInsuranceReplacementNoneRecommended certifiedEstate/ProbateFair Market706/1041IRS-qualified requiredCharitable DonationFair Market8283IRS-qualified requiredDivorce/LegalFair MarketVariesCourt-approved preferred

Business purposes, such as asset valuation for financial statements, may require additional compliance with accounting standards. These appraisals often need annual updates and must follow specific methodologies acceptable to auditors and lenders. Learning about common myths about antique silver appraisal can help you avoid misconceptions about these requirements.

Understanding these legal requirements protects you from costly mistakes and ensures your antique silver appraisals serve their intended purpose effectively. When significant value or legal proceedings are involved, working with qualified professionals who understand these complexities becomes essential for protecting your interests.

The legal landscape for antique silver appraisals continues evolving, but the fundamental requirements for accuracy, independence, and professional competence remain constant. By ensuring your appraisals meet these standards, you protect yourself from legal challenges while maximizing the value and utility of your antique silver collection.

Antique silver appraisals must comply with USPAP Standards 7 and 8 for personal property, include detailed documentation with high-quality photographs of hallmarks and condition, and be performed by IRS-qualified appraisers with proper credentials. For charitable donations over $5,000, the appraiser must complete IRS Form 8283 and cannot charge contingent fees based on appraised value.

Qualified antique silver appraisers must hold credentials from recognized organizations like ASA, ISA, or similar accredited bodies, demonstrate specialized knowledge in precious metals and historical periods, maintain state licensing where required, and have documented experience regularly appraising similar items. They must also maintain professional liability insurance and follow USPAP ethical standards.

Improper appraisals can result in IRS penalties of 20-40% of tax underpayments for overvalued charitable donations, insurance claim denials, unfair asset distribution in probate proceedings, and potential lawsuits. Appraisers themselves face credential loss, professional liability, and penalties up to $1,000 per violation for non-compliance with federal standards.

Insurance appraisals establish replacement value and aren't taxable events, estate appraisals require fair market value for tax calculations with executor liability, charitable donation appraisals over $5,000 need qualified professionals and Form 8283 completion within 60 days, and business appraisals may require annual updates following accounting standards.