The cannabis industry has grown into a multi-billion dollar market, with businesses investing heavily in specialized equipment for cultivation, extraction, processing, and packaging. When you need accurate valuations for financing, insurance, mergers, or legal disputes, a professional cannabis equipment appraisal becomes essential. These specialized assessments provide USPAP-compliant valuations that lenders, insurers, and courts accept as credible evidence of your equipment's worth.

A cannabis equipment appraisal is an independent, unbiased opinion of value prepared by qualified professionals who understand both equipment valuation standards and cannabis industry regulations. Whether you're securing asset-based lending, preparing for a business sale, or settling insurance claims, having defensible equipment values protects your financial interests and ensures compliance with regulatory requirements.

Key Insight: Cannabis equipment appraisals must follow Uniform Standards of Professional Appraisal Practice (USPAP) to be accepted by lenders, insurers, and courts. Non-compliant valuations can be rejected when you need them most.

Cannabis equipment appraisals differ significantly from standard machinery valuations due to the industry's regulatory complexity and specialized technology. Your appraiser must understand cultivation systems like LED grow lights, environmental controls, and irrigation networks, as well as processing equipment including extraction units, trimming machines, and packaging lines.

The federal-state legal divide creates additional challenges that generic equipment appraisers aren't equipped to handle. Cannabis businesses face unique banking restrictions, insurance limitations, and tax implications under Section 280E. A qualified cannabis equipment appraiser understands these constraints and how they affect equipment values and marketability.

Professional appraisers also recognize that cannabis equipment often becomes obsolete faster than traditional machinery due to rapid technological advancement and changing regulations. This accelerated depreciation must be factored into valuations to provide accurate, defensible results.

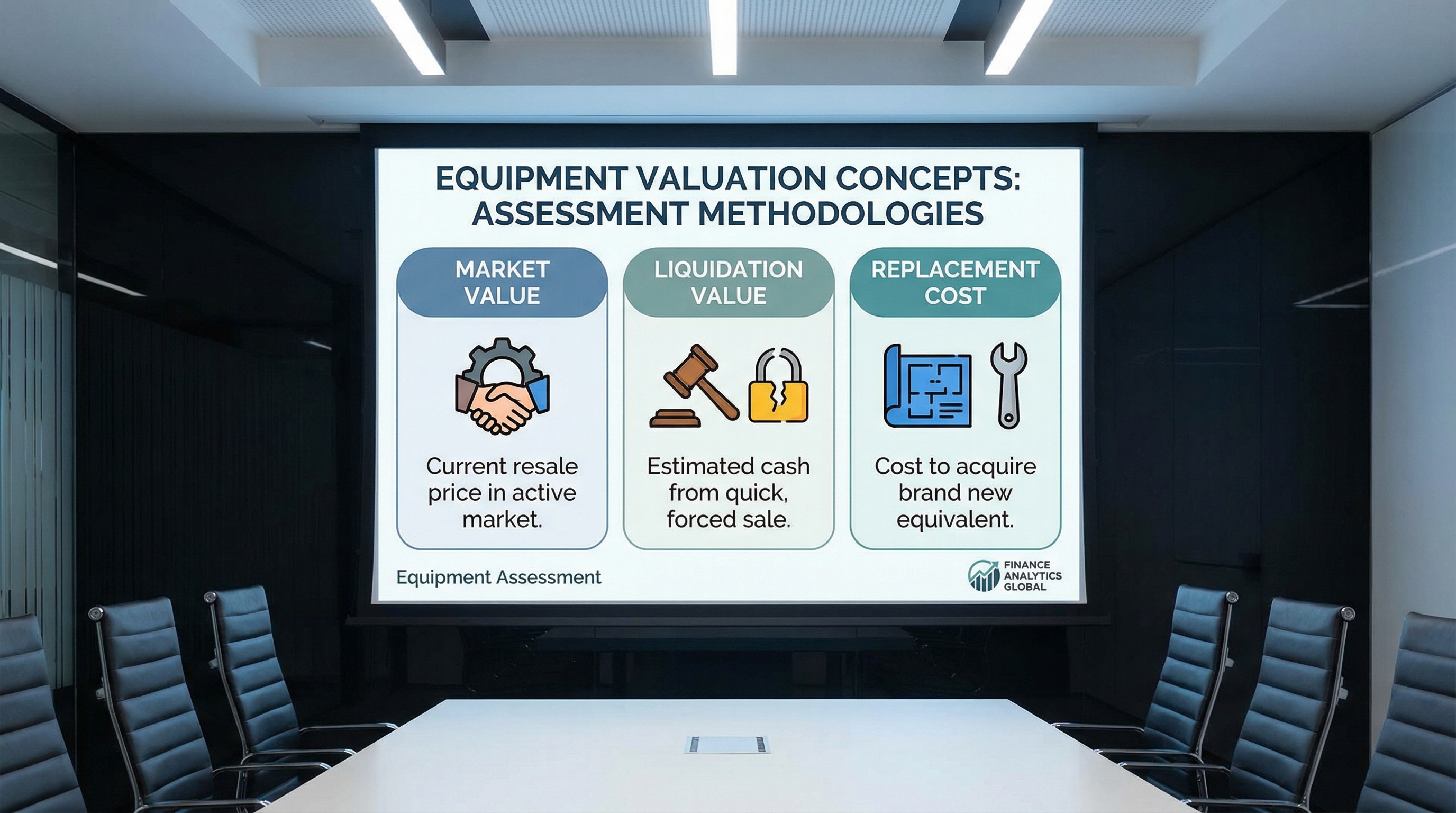

Different stakeholders require different value definitions depending on their specific needs. Fair market value represents the price a willing buyer would pay a willing seller in an open market, making it ideal for mergers, acquisitions, and partnership transactions.

Orderly liquidation value estimates what you'd receive if equipment were sold within a reasonable timeframe, typically used by lenders for collateral assessment and loan covenant testing. Forced liquidation value reflects quick-sale scenarios like bankruptcy auctions, while replacement cost helps insurers set coverage limits and assists with capital planning.

Value TypeDefinitionPrimary UsersCommon ScenariosFair Market ValueWilling buyer/seller transactionBuyers, sellers, lendersM&A, buyouts, refinancingOrderly LiquidationReasonable timeframe saleLenders, trusteesRestructuring, covenant testingForced LiquidationQuick auction saleCourts, lendersBankruptcy, foreclosureReplacement CostCost to replace with similarInsurers, ownersInsurance coverage, capex planning

Understanding the different types of cannabis equipment appraisals helps ensure your appraisal serves its intended purpose and meets stakeholder expectations.

The appraisal process begins with defining the assignment scope, including the purpose, intended users, and definition of value required. Your appraiser will request detailed equipment lists, purchase records, maintenance logs, and any modification documentation to understand what needs valuation.

For onsite appraisals, the appraiser physically inspects each asset, documenting condition, configuration, and any factors affecting value. Desktop appraisals rely on client-provided data and photographs, offering faster turnaround but potentially less precision for complex or high-value equipment.

Market research follows, where appraisers analyze comparable sales, replacement costs, and industry trends. They reconcile different valuation approaches to reach final value conclusions, then prepare a comprehensive report documenting their methodology, assumptions, and findings. Understanding the process of cannabis equipment appraisal can help you prepare for what to expect.

Compliance Note: USPAP requires appraisers to maintain independence and objectivity throughout the process. Any conflicts of interest or advocacy positions invalidate the appraisal's credibility.

The final report includes equipment descriptions, photographs, valuation methods, market data, and clear value conclusions with effective dates and intended use limitations. Before scheduling your appraisal, make sure you know what documents you need for a cannabis equipment appraisal to ensure a smooth process.

Your appraiser's qualifications directly impact your appraisal's credibility and acceptance by third parties. Look for professionals with current USPAP certification and credentials from recognized organizations like the American Society of Appraisers or American Machinery and Equipment Appraisers.

Cannabis industry experience is crucial because generic machinery appraisers lack understanding of cultivation cycles, extraction processes, and regulatory compliance requirements that affect equipment values. Ask potential appraisers about their specific cannabis equipment experience and whether they can provide expert witness testimony if needed.

Verify that your appraiser maintains professional liability insurance and follows documented quality control procedures. They should provide clear fee structures, realistic timelines, and examples of similar assignments they've completed successfully.

Red flags include appraisers who guarantee specific values, lack written engagement agreements, or seem unfamiliar with USPAP requirements. Remember that the cheapest option often proves most expensive if the appraisal gets rejected when you need it most. Learn more about what cultivators need to know about cannabis equipment appraisals to make informed decisions.

Professional cannabis equipment appraisers understand that your business depends on accurate, defensible valuations. At AppraiseItNow, our USPAP-compliant appraisers combine extensive equipment valuation experience with deep cannabis industry knowledge. We've helped hundreds of cannabis businesses secure financing, complete transactions, and resolve disputes with appraisals accepted by major lenders, insurers, and courts nationwide.

Whether you need fair market value for a business sale, liquidation values for lending purposes, or replacement cost estimates for insurance coverage, our team delivers the expertise and credibility your situation demands. Contact us today to discuss your cannabis equipment appraisal needs and receive a customized scope and fee quote.

A comprehensive cannabis equipment appraisal report includes a detailed asset inventory with descriptions, photos, and serial numbers; condition assessment and remaining useful life analysis; valuation approaches and assumptions; market data and comparable sales; concluded values for each asset and total portfolio; standard of value and effective date; and appraiser qualifications with USPAP compliance statement.

Cannabis equipment appraisal costs vary based on the number of assets, locations, complexity, and intended use. Factors include whether you need a desktop analysis or onsite inspection, the level of documentation required, and urgency. A brief value estimate costs less than a fully documented, court-ready report. Contact qualified appraisers for specific quotes based on your unique requirements.

Fair market value assumes a willing buyer and seller with reasonable marketing time in an open market. Orderly liquidation value assumes a limited but reasonable timeframe to sell assets under forced-sale conditions. Forced liquidation value reflects very short timeframes like auctions, typically resulting in lower values. The correct standard matters because lenders, courts, and insurers require specific value definitions for their purposes.

Most cannabis operators should reappraise major equipment every 3-5 years, or sooner if there are significant changes in regulations, market conditions, technology, or asset condition. Fast-evolving equipment like extraction systems and lab instruments may require more frequent appraisal than longer-lived fixtures, especially when supporting loans, insurance schedules, or potential business transactions.